Capital in the Twenty-First Century, by Thomas Piketty,

Cambridge: The Belknap Press of Harvard University Press, 2014. $39.95.

Arindam Sen

“A part of the bourgeoisie is desirous of redressing social grievances in order to secure the continued existence of bourgeois society.

The socialistic bourgeois want all the advantages of modern social conditions without the struggles and dangers necessarily resulting therefrom. To this section belongs economists, philanthropists, humanitarians.... They desire the existing state of society minus its revolutionary and disintegrating elements.”

– Manifesto of the Communist Party (1848)

A refreshing break from the reigning orthodoxy of mainstream economics, the title under review has already created a stir in the academia as well as among the general reading public. New York Times columnist and popular Blogger Paul Krugman has called the book “discourse-changing scholarship” and it has entered the magazine’s (and also Amazon’s) best-seller list – a rare achievement for a “heavy” economics text. First published last year in French and then in English this March, it is an incisive, wide-ranging, 696-page treatise, supported by an unprecedentedly vast array of data covering more than two centuries and more than twenty countries.

The discussion revolves round the theme of inequality. As we know, other left-of-centre mainstream writers have been dealing with broadly similar subjects long since, and that with great skill. Good old Amartya Sen published, back in 1973 – when TP was two years old – On Economic Inequality and wrote Inequality Re-Examined in 1992. More recently, Joseph Stiglitz wrote The Price of Inequality: How Today’s Divided Society Endangers Our Future while titles like The Haves and Have-Nots and Income Inequality: Economic Disparities and the Middle Class in Affluent Countries are coming out rather frequently since the crisis struck in 2007-08. These are valuable contributions, but two things make the new arrival very original, very special. One, the “World Top Incomes Database” and the data on the distribution and evolution of wealth, which have been collected by diligent team work over the last 15 or so years and on which Piketty’s inferences are based, will remain a great common resource for all researchers in the field, including those who totally disagree with TP.

“What actual changes have (Introduction) |

Indeed, the author is fully justified when he writes, “The sources on which this book draws are more extensive than any previous author has assembled, but they remain imperfect and incomplete.” And he says in the same breath: “All of my conclusions are by nature tenuous and deserve to be questioned and debated. It is not the purpose of social science research to produce mathematical certainties that can substitute for open, democratic debate in which all shades of opinion are represented.”

Two, linking inequality to capital, to “its vocation, its logical destination”, as explained below.

Historical Tendency of Rising Inequality

Thomas Piketty (TP) poses the central question in “Introduction”:

“… Do the dynamics of private capital accumulation inevitably lead to the concentration of wealth in ever fewer hands, as Karl Marx believed in the nineteenth century? Or do the balancing forces of growth, competition, and technological progress lead in later stages of development to reduced inequality and greater harmony among the classes, as Simon Kuznets thought in the twentieth century?”

For readers of Liberation there is no need to deliberate on the views of Marx; but a word on Kuznets should be in order.

In the middle of the 20th century Simon Kuznets proposed an inverted U-shaped relation between income inequality and economic growth. Thus goes his story: industrialisation and urbanisation begets greater inequality to start with, as industrialists and real estate developers get wealthier while huge labour supply from the countryside keep wages depressed. In time, however, rural labour flow declines or dries up and employment opportunities expand with spread of mass education, leading to raises in wages. Additionally, the lower income groups gain greater say in politics and succeed in changing government policies in their favour. Thus begins an equalisation process, which becomes more pronounced by and by. The whole thing can be graphically represented as an inverted U-shaped -- i.e., bell-shaped -- curve, known as the Kuznets Curve, showing the initial rise and the subsequent fall in inequality.

Kuznets’ thesis supplied intellectual ballast to the dominant dogma in mainstream economics, which claimed that growth alone was crucial and decisive, distribution was not particularly important. Because, it was claimed, growth always trickles down. To put it in former US president John F. Kennedy’s famous phrase, “a rising tide lifts all boats”.

This confident assertion now lies shattered in the face of Piketty’s new book, which stands Kuznets’ curve right side up: “what we see over the course of the century just past is an impressive “U-shaped curve.” The capital/income ratio fell by nearly two-thirds between 1914 and 1945 and then more than doubled in the period 1945–2012.”

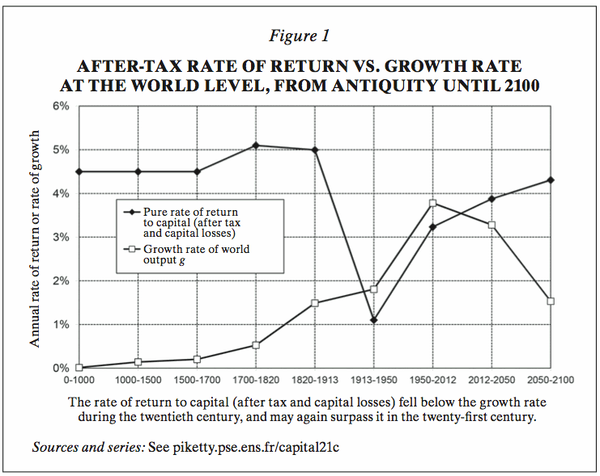

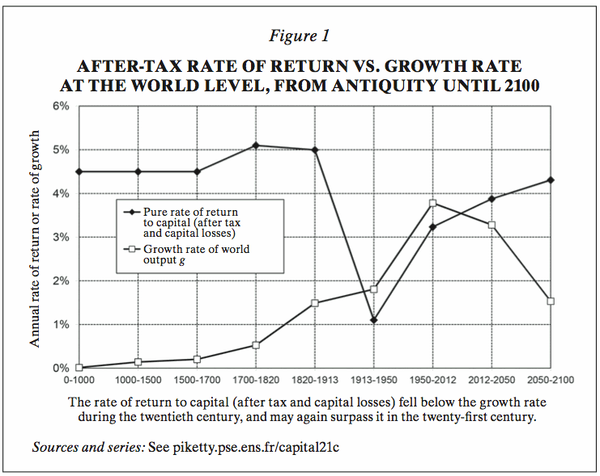

This finding relates directly to UK and France, but essentially similar has been the experience of the US, Germany and other advanced capitalist nations over the past three centuries. Only the chaos of the two world wars followed by the Great Depression disrupted this pattern. High taxes, inflation, bankruptcies, and the growth of welfare states caused wealth to shrink dramatically, and ushered in a period in which both income and wealth were distributed in relatively egalitarian fashion. Barring this exception, since 1700, wealth globally has enjoyed a typical pre-tax return of between 4% and 5% a year—considerably faster than average economic growth.

Answering the central question he posed (quoted above) TP says, “Modern economic growth and the diffusion of knowledge have made it possible to avoid the Marxist apocalypse but have not modified the deep structures of capital and inequality. When the rate of return on capital exceeds the rate of growth of output and income, as it did in the nineteenth century and seems quite likely to do again in the twenty-first, capitalism automatically generates arbitrary and unsustainable inequalities.”

“The Fundamental Structural Contradiction of Capitalism”

But why did – and does -- this happen? The basic reason lies in what TP rather overzealously calls “the central contradiction of capitalism: r > g”. Following a detailed investigation, he explains in the concluding chapter,

“The overall conclusion of this study is that a market economy based on private property, if left to itself, contains powerful forces of convergence, associated in particular with the diffusion of knowledge and skills; but it also contains powerful forces of divergence, which are potentially threatening to democratic societies and to the values of social justice on which they are based.

“The principal destabilizing force has to do with the fact that the private rate of return on capital, r, can be significantly higher for long periods of time than the rate of growth of income and output, g.

“The inequality r > g implies that wealth accumulated in the past grows more rapidly than output and wages. This inequality expresses a fundamental logical contradiction. The entrepreneur inevitably tends to become a rentier, more and more dominant over those who own nothing but their labor. Once constituted, capital reproduces itself faster than output increases. The past devours the future.

“The consequences for the long-term dynamics of the wealth distribution are potentially terrifying, and there is no simple solution. Growth can of course be encouraged by investing in education, knowledge, and nonpolluting technologies. But none of these will raise the growth rate to 4 or 5 percent a year. History shows that only countries that are catching up with more advanced economies—such as Europe during the three decades after World War II or China and other emerging countries today—can grow at such rates. For countries at the world technological frontier—and thus ultimately for the planet as a whole—there is ample reason to believe that the growth rate will not exceed 1–1.5 percent in the long run, no matter what economic policies are adopted.

“With an average return on capital of 4–5 percent, it is therefore likely that r > g will again become the norm in the twenty-first century, as it had been throughout history until the eve of World War I.”

“The big idea of Capital in the Twenty-First Century is that we haven’t just gone back to nineteenth-century levels of income inequality, we’re also on a path back to “patrimonial capitalism,” in which the commanding heights of the economy are controlled not by talented individuals but by family dynasties. It’s a work that melds grand historical sweep—when was the last time you heard an economist invoke Jane Austen and Balzac?—with painstaking data analysis. Piketty doesn’t just offer invaluable documentation of what is happening, with unmatched historical depth. He also offers what amounts to a unified field theory of inequality, one that integrates economic growth, the distribution of income between capital and labor, and the distribution of wealth and income among individuals into a single frame.” -- Paul Krugman Why We’re in a New Gilded Age, New York Times, May 8, 2014 |

What the Future Looks Like and What Is To Be Done

As we saw above, TP tries to strike a golden mean between “the Marxist apocalypse” and the exuberant optimism attributed (not entirely correctly) to Kuznets. He writes towards the end of the book (in chapter 13 to be precise):

“The new global economy has brought with it both immense hopes (such as the eradication of poverty) and equally immense inequities (some individuals are now as wealthy as entire countries). Can we imagine a twenty-first century in which capitalism will be transcended in a more peaceful and more lasting way, or must we simply await the next crisis or the next war (this time truly global)? …

“[T]he ideal policy for avoiding an endless inegalitarian spiral and regaining control over the dynamics of accumulation would be a progressive global tax on capital. Such a tax would also have another virtue: it would expose wealth to democratic scrutiny, which is a necessary condition for effective regulation of the banking system and international capital flows. A tax on capital would promote the general interest over private interests while preserving economic openness and the forces of competition.

“But a truly global tax on capital is no doubt a utopian ideal. Short of that, a regional or continental tax might be tried, in particular in Europe, starting with countries willing to accept such a tax.”

“The largest fortunes”, Piketty goes on, “are to be taxed more heavily.” However, the tax should be so calibrated that it limits rentier wealth but does not suffocate entrepreneurship (including “primitive accumulation”). … This would contain the unlimited growth of global inequality of wealth, which is currently increasing at a rate that cannot be sustained in the long run and that ought to worry even the most fervent champions of the self-regulated market.”

“A progressive tax on capital”, TP adds, “is a more suitable instrument for responding to the challenges of the twenty-first century than a progressive income tax, which was designed for the twentieth century (although the two tools can play complementary roles in the future).”

As an auxiliary measure, Piketty advocates a very high marginal tax on the highest incomes – in his words, “confiscatory tax rates on incomes deemed to be indecent (and economically useless)” -- aimed mainly at the exorbitant pay of top corporate executives. The purpose of the tax would be not to generate revenue but to make such pay futile. He also recommends liberal social sector spending by the state.

Far from restricting himself to economic measures alone, Piketty attaches much importance to continual institutional reforms to save capitalism:

“When it comes to organizing collective decisions, the market and the ballot box are merely two polar extremes. New forms of participation and governance remain to be invented.

The essential point is that these various forms of democratic control of capital depend in large part on the availability of economic information to each of the involved parties.

For collective action, what would matter most would be the publication of detailed accounts of private corporations (as well as government agencies). … For example, to take a concrete case mentioned at the very beginning of this book, the published accounts of Lonmin, Inc., the owner of the Marikana platinum mine where thirty-four strikers were shot dead in August 2012, do not tell us precisely how the wealth produced by the mine is divided between profits and wages. This is generally true of published corporate accounts around the world … It is then easy to say that workers and their representatives are insufficiently informed about the economic realities facing the firm to participate in investment decisions. Without real accounting and financial transparency and sharing of information, there can be no economic democracy. Conversely, without a real right to intervene in corporate decision-making (including seats for workers on the company’s board of directors), transparency is of little use. Information must support democratic institutions; it is not an end in itself. If democracy is someday to regain control of capitalism, it must start by recognizing that the concrete institutions in which democracy and capitalism are embodied need to be reinvented again and again.” (From Chapter 16)

Right Book at the Right Time

So this is essentially what the forty-three-year-old professor at the Paris School of Economics has to say. The title has received the attention and admiration it has not just on account of its own intrinsic merit. Equally important, the current economic situation and political mood across the world have made it the right kind of book today. And this is in two senses.

First, the book comes at a time when economic inequality is at highest levels in the global North since the end of World War II. In the US for example, real wages of most workers have virtually stagnated since the 1970s, but “supersalaries” have risen by 165 percent and 362 percent for the top 1 percent and the top 0.1 percent respectively. On the other hand, over the last forty years, the top marginal tax rate in the country has declined from 70 to 35 per cent. With outrageously unequal income and wealth resurfacing as a central political issue, sharp intellectual debates have been spilling on to the streets in the shape of massive protests like the Occupy Movement (which was launched on behalf of “the 99%” against the richest and most powerful 1%) and the anti-austerity struggles. In this context, TP’s work – seen as a continuation of such movements by other (theoretical) means – has inspired new courage of conviction among “the 99%”. Not surprisingly, the book has achieved the highest popular recognition precisely in the Occupy Movement’s country of origin, which is also one of the most inegalitarian societies today. Piketty’s emphatic assertion that “if we are to regain control of capitalism, we must bet everything on democracy” also seems to have touched a sensitive chord among the general public in the US and beyond.

The second objective reason seems to lie in the inability of Western economies to restart real growth even six years after the global financial and economic crisis started. This has generated a trust deficit in orthodox explanations and prescriptions, motivating people to try and understand the causes of and possible cures for the persistent economic woes from an alternative viewpoint. In this sense, the same urge that prompted people in large numbers to reach out to Capital just after the crisis broke out, has been operative in the case of ‘Capital 21’ too.

The Modern Marx?

Even as Piketty’s book faced hostile attacks from the far right including outspoken mouthpieces of the financial oligarchy (The Forbes magazine for example) it was vigorously promoted by more mature forums of monopoly capital. The Economist, apart from carrying a regular review article well before the publication of the English version of the book, serialised a chapter-by-chapter study of the text in nine issues during February-April this year. The White House and US Treasury held talks with the author of Capital in the Twenty-First Century soon after its publication. On 16 April this year, the City University of New York Graduate Center organised a talk by Piketty on his new book, with Stiglitz, Krugman and others as commentators and moderators. Similar events have been organised elsewhere too.

This level of keen interest no doubt reflects the ruling class’s anxiety over the menacing growth of inequality. Not just the Sen-Stiglitz-Krugman-Piketty fraternity, now even the IMF is paying much attention to it. In her recent Richard Dimbleby lecture in London (February 3, 2014), Christine Lagarde, managing director of the IMF, treated this as one of the three most pressing problems of the world. She said, “… seven out of 10 people in the world today live in countries where inequality has increased over the past three decades… the richest 85 people in the world own the same amount of wealth as the bottom half of the world’s population… In India, the net worth of the billionaire community increased 12-fold in 15 years, enough to eliminate absolute poverty in this country twice over.

“… a severely skewed income distribution” , she warned, “harms the pace and sustainability of growth over the longer term.”

So what was to be done? “Think about making taxation more progressive”, she suggested, “improving access to health and education, and putting in place effective and targeted social programs. … make sure that “inclusion” is given as much weight as “growth” in the design of policies.”

To be sure, such worries are nothing new. The desperation to find and fix the basic problem leading to repeated crises became particularly pronounced in the wake of the crisis of 2007-08. Back then, Financial Times conducted an extensive discussion focussed on Marx’s Capital and featured an interview with Jason Barker titled “Can Marx Save Capitalism?”; now The Economist has hailed Thomas Piketty as “The Modern Marx”. Well, they think they have found a sterilised, innocuous Marx, who is not questioning the foundations of capitalism – such as the extraction of surplus value – or the devastating ways of present day imperialism. A mellowed Marx, who instead of saying expropriators will be expropriated solemnly declares: rentiers will be heavily taxed!

“The pragmatic policies adopted after the crisis of 2008 no doubt avoided the worst, but they did not really provide a durable response to the structural problems that made the crisis possible, including the crying lack of financial transparency and the rise of inequality. The crisis of 2008 was the first crisis of the globalized patrimonial capitalism of the twenty-first century. It is unlikely to be the last.” (Chapter 13) |

Piketty himself, while choosing a title that evidently alludes to Marx’s Magnum Opus, has clarified that he never had any particular sympathies for Marxism or communism. Even his definition of capital (any wealth, under any social and economic system, which generates a return) differs absolutely from Marx’s (the intrinsically exploitative defining relation of production under capitalism). Indeed, in terms of objective, approach, method, argument, and prognosis, Das Kapital and so-called Capital 21 are as different as chalk from cheese. So engaging in polemics with Piketty from the standpoint of the Marxist understanding of capital and inequality does not seem to be the most important thing to do at this stage. Perhaps a better way to conclude this review would be to take note of the theoretical-political space we share with the progressive critical analyst and insightful historian of capitalism.

TP’s Prognosis and the Left

TP warns readers that rising global wealth and income inequality over the past generations is actually the norm for capitalist economies, and that, left to itself, the trend will continue in the years to come. None of his critics have been able to disprove the rise in pre-tax wealth and income inequality on national and international planes. He has brought the lately neglected category capital/ accumulated wealth back to the centre of the discourse on inequality, and cast new light on the dynamics of its long-term evolution. Marxists take all these as valuable inputs to update and enrich their own understanding of capitalism.

TP speaks of “fundamental structural contradictions” of capitalism and warns about the next major crisis. Marxists take a step forward, saying that the latest crisis – which is still continuing in other forms (stagnation, job crunch, public debt explosion etc.) – is itself structural and epochal. As such, it is likely to lead to, short of revolution, a restructuring of capitalism, as happened in the past. Piketty’s forceful intervention, coming as it does in a backdrop of growing anxiety about inequality (as epitomised, inter alia, in Lagarde’s speech) and given the attention and support it has received from people who matter, can help initiate or accelerate that process, if only in a very small measure. This is something we welcome, because the reforms suggested by Piketty are directed against the top 1% and in favour of the 99%.

TP believes that strong state intervention can and should be made to correct the dangerous asymmetry between r and g. Stiglitz made the same point in the aforementioned discussion at the Graduate Center. “It isn’t inevitable that r be greater than g. It’s the effect of our policies” – he said, and pleaded for drastic policy changes in the light of what was done in the US during the Great Depression. That is what Piketty also recommends. None of them, naturally, tells us that the mega-taxation and New Deal in the US were made possible only under the pressure of powerful working class movement, in part facilitated by progressive TU legislation. This time too, Marxists recon, vigorous class action from below alone can force the ruler’s hand to reverse the neoliberal policy package, thereby paving the way for a more inclusive and therefore relatively robust and sustainable growth. Understandably, intensification of class struggle is something our friendly fellow travellers do not and cannot recommend, but we on the Left must work for.

One last word. Some commentators have expressed disappointment over the apparently lacklustre ending (no spectacular proposals) of this otherwise impressive work. One of them wrote that readers would like to know the author’s take on the likely outcome of the alarming rise in inequality – whether left-of-centre governments or revolutions? However, we believe the author is fully justified in remaining within the logical boundaries of his intervention (“my purpose here is not to plead the case of workers against owners but rather to gain as clear as possible a view of reality”, says PT). He has also made his preferences abundantly clear: “a social state (his version of welfare state – reviewer) for the 21st-century”; vibrant democracy and entrepreneurial capitalism in place of oligarchic or “patrimonial capitalism”; and finally, progressive taxation of wealth and top incomes – a bitter pill no doubt, but ultimately less costly, he feels, than alternatives like protectionism, capital controls and of course, communism. If he stops here, without trying to say how the apparently utopian idea progressive global tax on capital could be put into practice, objectively it is an honest admission that finding real remedies for the festering wounds of capitalism is just not possible within the limits of bourgeois political economy. This by no means detracts from the value of this path-breaking study.